Technology for credit, insurance and real estate sectors

Hypoport Group is a network of technology companies for the credit, real estate and insurance industries with a workforce of more than 2,000 employees. It is grouped into three segments: Real Estate & Mortgage Platforms, Insurance Platforms and Financing Platforms.

Within the Hypoport Group, Hypoport SE performs the role of a strategic and management holding company with corresponding central functions. Hypoport SE’s objectives are the advancement and expansion of its family of subsidiaries. The shares of Hypoport SE are listed in the Prime Standard segment of the Frankfurt Stock Exchange (Deutsche Börse) and are included in the SDAX or MDAX (160 or 90 largest listed companies in Germany respectively) since 2015.

Investors highlights

- Network of technology companies for the credit, real estate and insurance industries.

- Strong organic growth of previous years continues and has been combined with growth by acquisition in the new Insurance Platform business unit since 2016.

- Significant potential in the housing market guarantees long-term business success.

- Regulation and pressure on margins are accelerating the digitalisation of credit, real estate & insurance industries and boosting the revenue potential of Hypoport Group.

- Balance sheet structure and reliable cash flow create financial scope for growth.

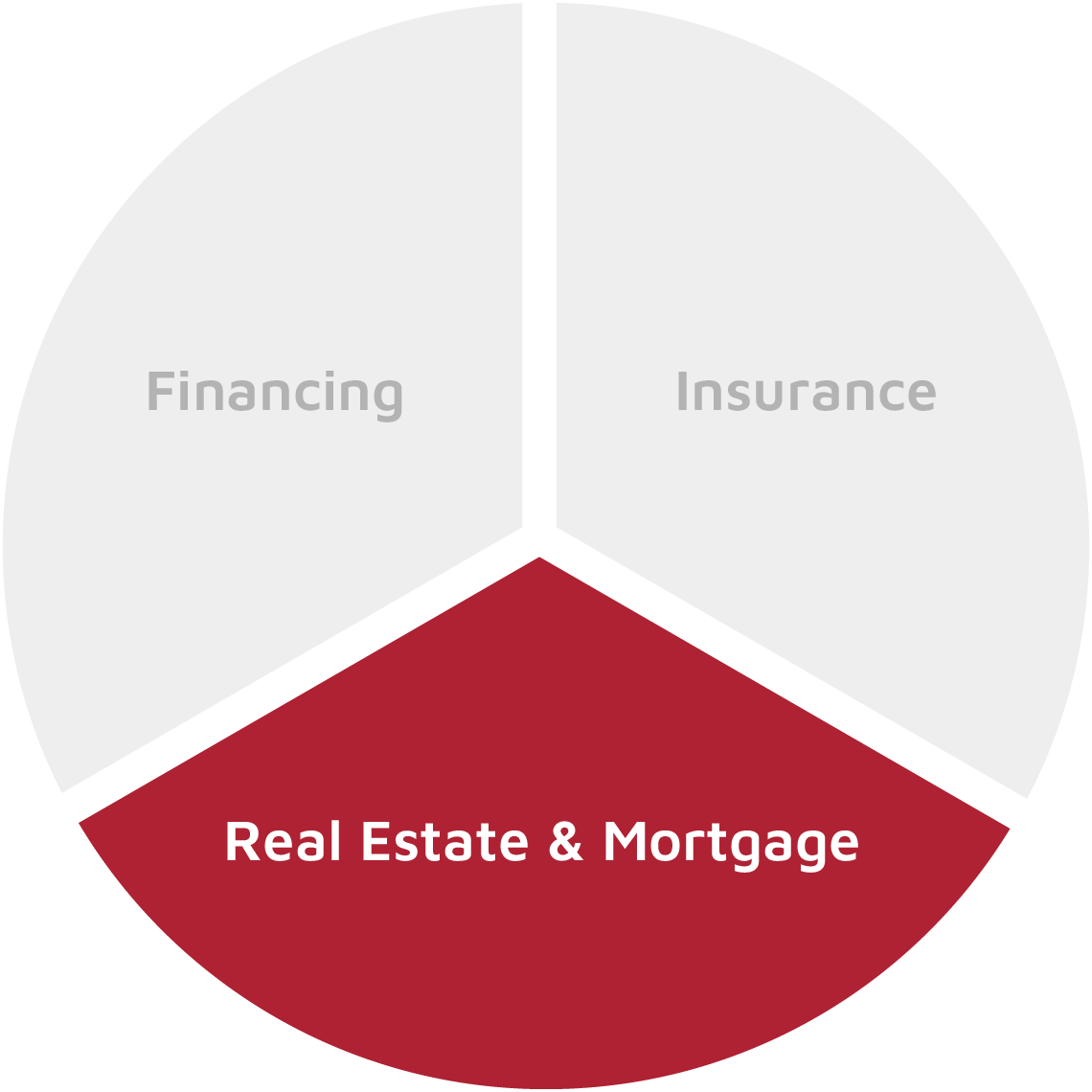

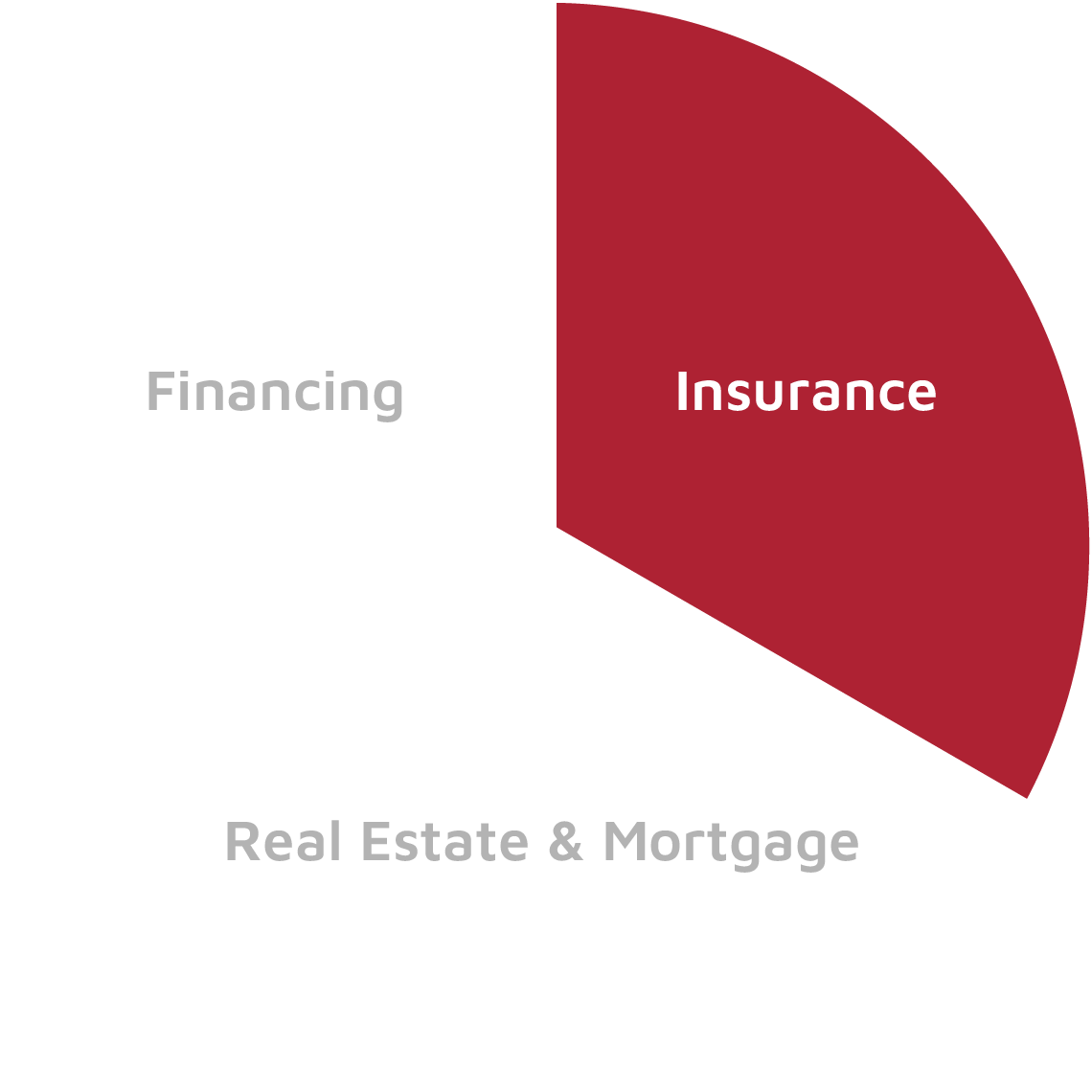

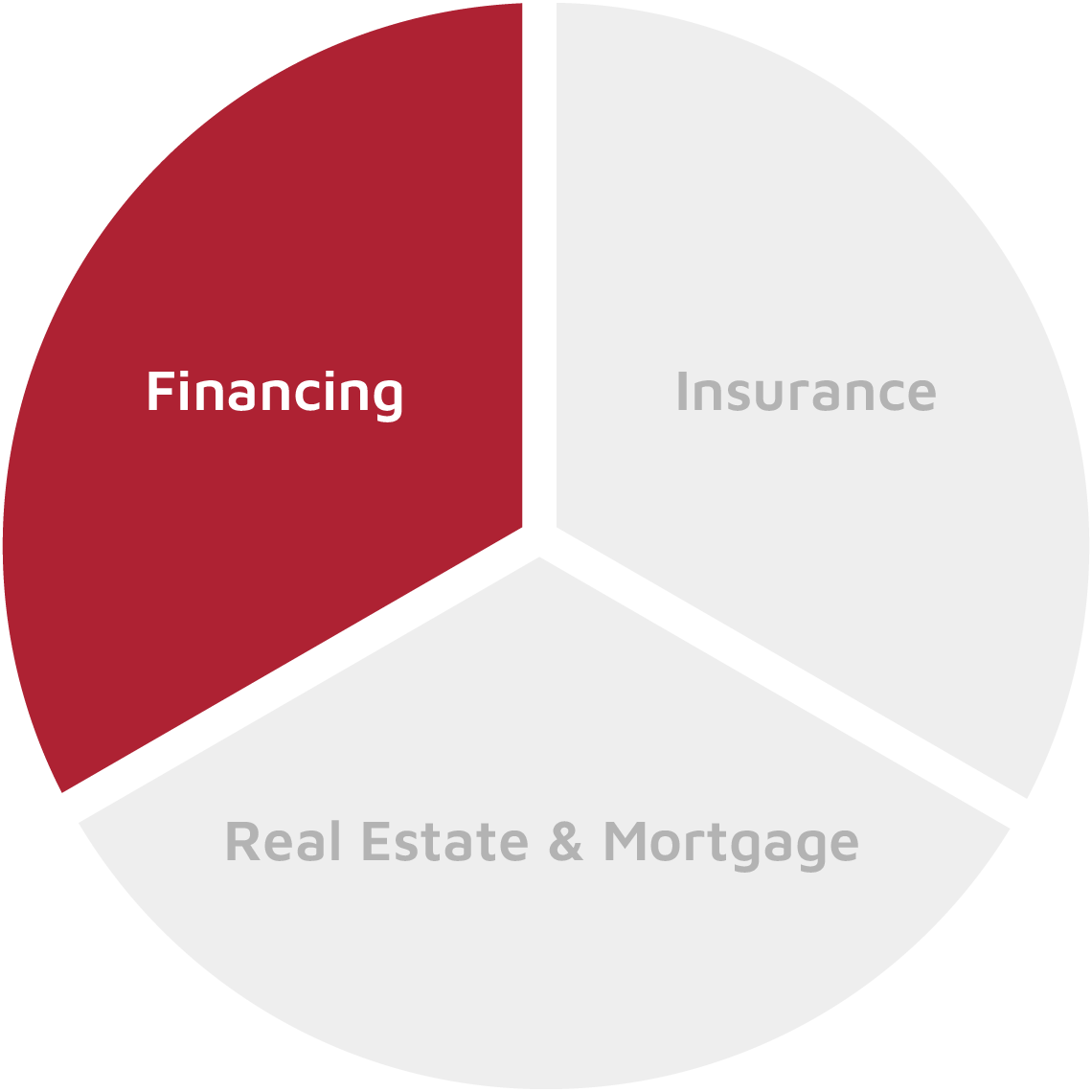

Hypoport’s three segments

The Real Estate & Mortgage Platforms segment operates the internet-based B2B credit marketplace Europace, Germany’s largest platform for real estate financing and home loan products. In addition to Europace, the Finmas and Genopace sub-marketplaces and the B2B sales companies Qualitypool and Starpool, the independent B2C financial sales company Dr. Klein also promote the growth of the credit marketplace. The technological business models of Fio Systems for marketing of residential real estate and Value AG for valuation of properties complement the value chain for real estate acquisition by end consumers.

The Insurance Platforms segment operates Smart Insur, an internet-based B2B platform for rateable private and commercial insurance policies for small business. With the insurance division of the B2B sales company Qualitypool and the underwriting agent Sia, two service companies support the growth of the Smart Insur platform. In addition, Corify and ePension are B2B platforms for the administration of industrial insurance and occupational pension insurance respectively.

The Financing Platforms segment combines all the Hypoport Group’s technology and sales companies for consumer finance, corporate loans and institutional housing finance products. It therefore comprises business models outside the area of mortgages for end consumers.